Project capitalization is the process of temporarily removing project cost and/or revenue from the Profit&Loss statement. The capitalization postings can either be added to the transaction voucher during general ledger update, or be created in a separate periodical process. The method can be decided for each individual project. Projects that use periodical capitalization have the option to maintain two independent capitalization principles (project types) in the General Ledger (GL) and in one selected Internal Ledger (IL). When separate GL/IL rules are in use, the posting process will be controlled by voucher types that are specific to each ledger. Using a voucher type that only update a selected ledger will avoid duplicating capitalization entries in one ledger against the other. When used with periodical capitalization, revenue recognition for a project can also be executed independently in GL and for a selected IL.

In addition to the above, the following options are also available for projects that use periodical capitalization:

Regardless of using periodical or transaction based capitalization, some other important options are also available:

The capitalization posting method for a project can have the values Transaction or Periodical

Transaction - With this setting, project capitalization postings will be created automatically when a cost or revenue voucher row is updated to the general ledger.

Periodical - Capitalization for projects with this setting will take place as a periodical process initiated by the user. This process can run at the end of any accounting period.

Options available when using each capitalization posting method are:

| Option | Capitalization Posting Method = Transaction | Capitalization Posting Method = Periodical | |

| Separate GL/IL rules not selected | Separate GL/IL rules selected | ||

| One project accounting principle that affect all ledgers | ü | ü | |

| Separate project accounting principles in GL and IL | ü | ||

| Create capitalization postings during GL voucher update | ü | ||

| Create capitalization voucher rows in the original cost/revenue voucher | ü | ||

| Multiple reposting rules | ü | ü | ü |

| Change project type when re-open a project | ü | ü | ü |

| Revenue recognition as a periodical process | ü | ü | ü |

| Capitalization postings created as a period-end process | ü | ü | |

| Ability to exclude accounts from the capitalization process | ü | ü | |

| Ability to exclude activities from the capitalization process | ü | ü | |

| Partially complete a project with a percentage or an amount | ü | ü | |

| Execute project completion for a selected subproject | ü | ü | |

The process of periodical capitalization is initiated by setting the capitalization posting method to Periodical for the project. This could be defaulted from the project group as well. The capitalization positing method cannot be changed for projects that already have capitalization postings.

When the capitalization posting method is set to Periodical, the system will not create capitalization entries (postings) for the project when cost or revenue vouchers are updated to the GL. Instead capitalization will be initiated by a periodical process.

If periodical capitalization is used for a project, capitalization and revenue recognition can be executed differently in the internal ledger compared to how it is done in the general ledger. This allows companies to execute project accounting in accordance to two selected accounting guidelines, e.g. US GAAP and IFRS, in IL and GL.

Only one internal ledger in a company can be set-up to use this functionality. This is done by selecting the IL Project Accounting check box in the Define Internal Ledgers window. This is only allowed for an internal ledger where the code part for project accounting is included.

All projects set-up for periodical capitalization can have separate project accounting principles in GL and IL. This is enabled by selecting the option Separate GL/IL Rules. Projects with this setup can hold two sets of project capitalization and revenue recognition principles in the following basic data windows:

Voucher types from two function groups will be used when periodical capitalization is in use:

In order to maintain capitalization and revenue recognition independently in two ledgers, the system has to post those entries independent to each ledger as well. The number of ledgers each voucher is posted to is controlled by the Ledger Selection field in the Define Voucher Type window. This field can have following values:

To execute periodical capitalization with separate GL/IL rules, 3 voucher types from function group PPC must be defined. If periodical capitalization is not used by the company, voucher types from the function group PPC are not required.

| Description | Function Group | Ledger Selection | Ledger ID |

| Voucher type 1 for function group PPC This voucher type will be used to post periodical capitalization entries for projects that do not use separate GL/IL rules. |

PPC | GL, affect IL | * |

| Voucher type 2 for function group PPC This voucher type will be used to post periodical capitalization entries in general ledger for projects that are set up to use separate GL/IL rules. |

PPC | GL only | GL(00) |

| Voucher type 3 for function group PPC This voucher type will be used to post periodical capitalization in internal ledger for projects that are set up to use Separate GL/IL Rules. |

PPC | IL only |

Ledger ID of the internal ledger |

Three voucher types from function group P are needed when working with project that use Separate GL/IL Rules.

| Description | Function Group | Ledger Selection | Ledger ID |

| Voucher type 1 from function group P This voucher type will be used to post the following transactions to all ledgers for projects that are set up with capitalization posting method Transaction:

The voucher type will also be used to post the following transactions to all ledgers for projects that are set up for Periodical Capitalization but do not use separate GL/IL rules:

|

P | GL, affect IL | * |

| Voucher type 2 from function group P This voucher type will be used to post the following transactions in general ledger for periodical capitalization projects that are set up to use separate GL/IL rules.

|

P | GL only | GL(00) |

| Voucher type 3 from function group P This voucher type will be used to post following transactions in internal ledger, for periodical capitalization projects that are set up to use separate GL/IL rules.

|

P | IL only | Ledger ID of the internal ledger |

The voucher types from function group PPC, which should be used when posting periodical capitalization to each ledger combination, can be defined in Periodical Capitalization Information window.

The voucher types from function group P, which should be used when posting revenue recognition to each ledger combination, can be defined in Revenue Recognition Information window.

The process of project execution or posting of day to day transactions to project using periodical capitalization is not different to how it is done for projects using transaction based capitalization. Project transactions are still created and used in the same way in all components, for example IFS/Purchasing, IFS/Manufacturing.

The periodical capitalization and revenue recognition process can be initiated at the end of a selected accounting period from periodical capitalization and revenue recognition.

This process can be defined for the unique combination of accounting year/period and ledger in a company. It is possible to create up to 3 PCRR records for each accounting period with the following ledger selections:

| Ledger Selection | Description |

| All Ledgers | This alternative covers two different situations:

|

| General Ledger | Used for general ledger periodical capitalization and revenue recognition when projects are set up for periodical capitalization with separate GL/IL rules |

| Internal Ledger | Used for internal ledger periodical capitalization and revenue recognition when projects are set up for periodical capitalization with separate GL/IL rules |

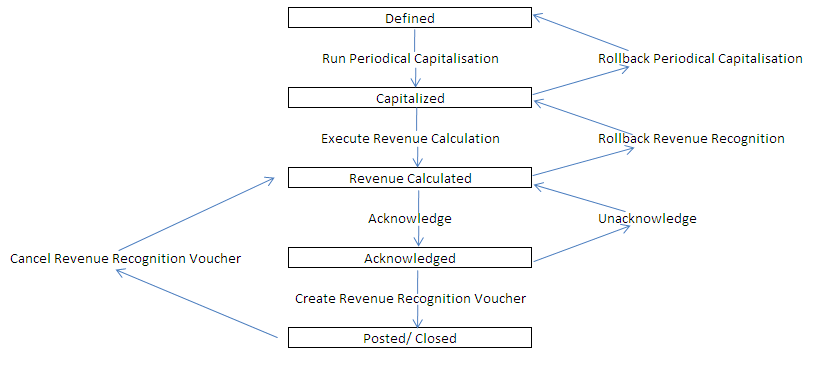

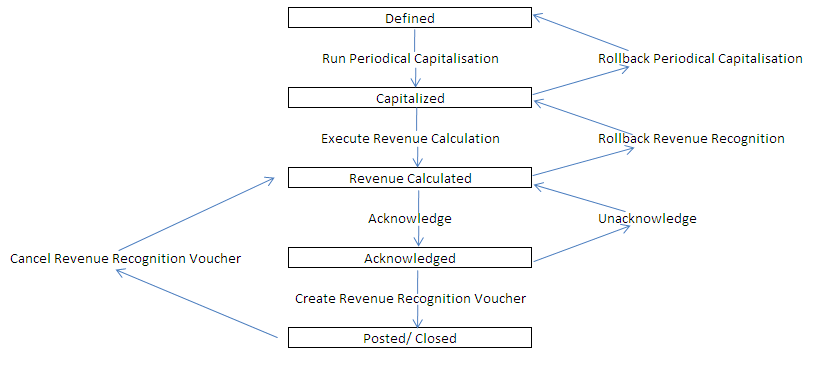

Once defined, this process will pass through the following statuses:

| Status | Description |

| Defined | This will be the status of the entry when it is created |

| Capitalized | Periodical capitalization has been run and posted for this process |

| Revenue Calculated | Calculate revenue recognition has been executed |

| Acknowledged | Calculated revenue recognition has been acknowledged |

| Posted/Closed | Revenue recognition voucher has been created |

Periodical capitalization and revenue recognition is a period-end process which needs to be performed as one of the last operations of a period. All transactions for the period must be completed and all vouchers must be updated to the GL. It is recommended that the period is closed for all user groups other than the one working with this process.

This process should be repeated for all ledgers that are relevant.

If periodical capitalization is used, it is possible to exclude accounts from the capitalization and revenue recognition process. This provides the possibility to exclude some types of expenses and revenues from project capitalization, which is a legal requirement in some countries.

This option is available for accounts with logical account types Cost, Revenues and Statistics. It is possible to indicate if the account should be excluded from capitalization in GL, IL or in both ledgers.

If periodical capitalization is used, it is possible to exclude project activities from the capitalization and revenue recognition process. It is possible to indicate if the activity should be excluded from capitalization in GL, IL or in both ledgers. The setting cannot be changed if the activity contains any used cost.

This allows project managers to exclude some parts of the project structure from the capitalization process. Cost and revenue from those selected parts will be reported directly to the P&L, where as cost and revenue from all other activities are capitalized based on project settings.

It is possible to enter more than one code string in the Cost Reposting Rule that will be used when completing a project. The distribution percentage field in the reposting rule indicates the cost percentage to be posted to each code string. The system will validate that the total of distribution percentage is equal to 100 when defining a reposting rule for a project or a project group. A reposting rule for a project group will be defaulted to projects connected to the project group, but can be modified for the individual project. When doing project completion for a project, the project's reposting rule is suggested in the completion dialog, but it can be modified.

Projects may need to be completed partially during the life of the project. This can be achieved by reducing the Completion Amount or Percentage in the Project Completion dialog box. This is only allowed for projects that are set up for periodical capitalization and has a cost reposting rule. It will not be allowed to carry out a partial completion if any of the sub projects of the selected project is financially completed. A partial completion can be rolled back from a right-click option in the Project Completion Details window.

If the partial project completion includes revenues, it is necessary to set up GP18 - Partial Project Revenue Completion in posting control. During the final completion of a project, all partial completions will be rolled back. A new project completion voucher will then be posted for the full completion of the project.

When used with periodical capitalization, it is possible to financially complete part of a project without affecting other parts of the project structure. In order to financially complete a sub project, all activities under this sub project (including the activities on sub subprojects) need to be is status Completed or Canceled. This process can be executed from the Project window in IFS Financials where you can right-click and then click Sub Project Completion. Rollback is available from the Project window as well as the Project Completion Details window. Once this is executed, all sub projects and activities under the selected sub project will be marked as Financially Completed. No changes will be allowed for subprojects and activities that are financially completed.

Subproject completion postings will not be rolled back during a final completion of the project. Final completion will select all non-completed activities and create a completion voucher to reverse the capitalization of those activities.

A closed project may need to be re-opened to be able to process a one-off transaction like a warranty claim. In support of this and other scenarios, all rules for a project can be changed during the re-open process. If a project is re-opened, it will be logged in the project completion details.

Example: If the original project was set up to capitalize expenses, the project type can be changed to No Capitalization during the re-open process. This allows posting of new expenses directly to the P&L without any capitalization entries.